What happened to coin confidential?

Note from me: I’ve been getting quite a few emails asking what happened to coin confidential. So, I’m reposting my “farewell issue” of coin confidential below, which originally went out in July 2024.

The Farewell Issue

I’ve been writing these articles for five years now.

When I started the crypto industry was viewed as a dud.

Just a blip on the cultural radar that made a few people rich in 2017 and lost thousands of people money when it crashed in 2018.

If I’d written back then that in five years’ time, crypto would be one of the key topics of the 2024 US Presidential election, you’d have probably thought me insane.

But here we are.

Over the last five years, crypto – and Bitcoin in particular – has gone from “magic internet money” to a trusted “digital asset”.

It’s become the subject of numerous ETFs from the biggest asset managers in the world.

And been recognised as an important and groundbreaking development in the world of economics and finance.

Although, admittedly, the promises of blockchain itself and “web3” have so far amounted to zilch.

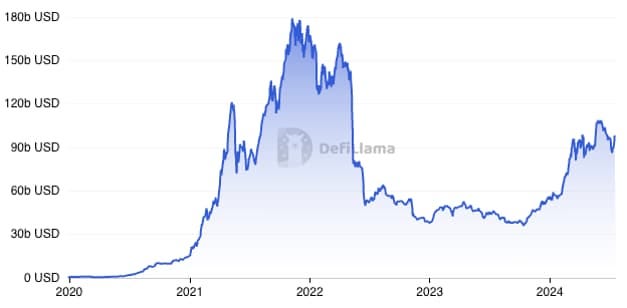

Decentralised finance (DeFi) really looked like it might change the world in early 2022.

But a few months later, crypto had its own “2008 moment” (see: this week in crypto: 4,032,064 [actually, don’t. That link won’t work anymore.]) and all hopes were dashed.

But that hasn’t stopped the crypto market as a whole growing from $2.3 billion in May 2019 to $2.3 trillion today…

Bitcoin growing from $7,000 to $58,000…

And Ethereum growing from $190 to $3,000.

Will DeFi come back?

Given the history of crypto and the thousands of times it’s been declared “dead” over the years… I’m almost certain it will.

But it’s probably going to take a while to decouple from the traditional financial system now – if it ever does.

More on that in a minute…

First, I’m going to address the title of this edition: the farewell issue.

So, let’s cut to the chase.

I intend this to be my last ever issue of coin confidential

Here’s what that means for you.

I’m sending this issue to premium members today, and then I’ll send it out to free members in two weeks’ time.

When I sent this issue out, I cancelled your paid premium subscription and then moved you onto a complimentary premium subscription.

So I won’t take any further payments from you.

Why have I moved you onto a complimentary premium subscription?

I intend to leave the premium part of the site open for the next couple of weeks.

So that will give you a chance to re-read any of my deep dives that you haven’t gotten around to yet.

After that I will remove the premium sections of the site.

And a few weeks after that I’ll close the site entirely.

Why am I closing coin confidential?

I’m still interested in crypto. I still read about and research it most days. And I still believe in it just as much as I did when I first started this site in 2019.

But, a lot has changed in the last five years.

There are two main reasons I’m closing the site.

1. New regulations

If you’re a long-time reader, I’m sure you’ve noticed my writing changing.

When I first started this site, crypto wasn’t regulated like stocks and shares. Now it basically is.

Actually, in many ways it’s even more regulated.

What that means in practical terms is I can’t write anything about any crypto story or project that could be interpreted as investment advice.

And I also can’t advertise this site.

If the Financial Conduct Authority decided that by advertising this site I was encouraging people to invest in crypto, I could face “an unlimited fine and up to two years in jail”.

So, not only can I not write about crypto in a way that’s most interesting to people. I also can’t do anything to grow the site.

Which means it can never become something I could start doing full-time.

At the moment, I have around 750 subscribers, 66 of whom are paying £10 a month – which is honestly really cool.

When I first launched coin confidential, I thought maybe 10 people would choose to go premium.

At one point I think we went up to 85 paid subscribers.

But, although I am super happy with this – it’s nowhere near enough money to risk “an unlimited fine and up to two years in jail”.

I actually can’t think of a figure that would be.

Since the new rules came in I’ve been extremely careful to not write anything that could be taken as “an inducement to invest”. But even so, I’m not a lawyer and I wouldn’t like to argue my case in court.

The only way to get around this issue would be for me to train as a financial advisor and register with the FCA. Then get a compliance department to look over everything I write.

I don’t have the time, the desire or the capital to do this.

And even if I did, I still wouldn’t be able to grow the site.

You can only advertise anything crypto-related to accredited investors. But even just advertising to accredited investors could still get you into trouble.

2. To open up space for something new

As much as I enjoy writing about crypto, I feel like it’s time for a new chapter.

Five years is a long time to spend on just one topic… even one as interesting as crypto.

Before I focused in on crypto I used to write about all kinds of topics, from tech, finance and economics to futurism, philosophy and psychology.

Admittedly, I do manage to shoehorn a lot of that into these issues, but I’m always aware I shouldn’t stray too far from the crypto path.

And by closing this site, it will give me space to explore a far wider range of topics.

With that in mind…

I’m starting a new newsletter called Minor Insight

So, if you like my writing, you can subscribe to my new free newsletter at minorinsight.com.

(If you follow that link, you’ll see it says I launched it three years ago. But that’s just when I registered the domain. I haven’t actually written anything yet.)

It’s going to be a good few weeks before I post anything there, because I want to take a break over the summer.

[Yeah, I know… I still haven’t posted my first article here yet. My summer off from projects is tipping towards an autumn off as well.

In a turn of events I should have – and, to be honest, did – see coming, see my main full-time job has expanded to fill the space I used to carve out for coin confidential.

If you didn’t know, I work as a very niche kind of financial copywriter. I write 8,000-12,000 word scripts for former Wall Street guys about financial ideas/strategies.

And they read these out on camera to sell their investment research services.

Like I said, it’s very niche. I enjoy it because – as you know – I like playing with ideas. But it’s also the kind of work that can take over your entire life.

But I want to write about more than just finance – hence this site. And I will be writing my first issue by the end of the year.]

I’ll eventually start writing roughly one issue a month.

If you decide to stick with me on this journey, what can you expect?

I want to use minor insight to explore topics and ideas that I want to know more about.

The kind of things that you read about and you go, “huh, that’s interesting…” and you always intend to do some more research into it, but you never do.

Those are the ideas I want to look into.

So the topics could be about anything from cognitive dissonance in Aesop’s Fables…

To why the U-shaped age happiness curve seems to match the U-shaped friendship curve…

To the fermi paradox and the terrifying idea of the Great filter…

To why so many “tech bros” ended up turning to stoic philosophy…

To what Captain Ahab lamenting “Have I lived enough Joy?” in Moby Dick can tell us about A-symmetrical happiness activities.

(Actually, now that I think about it, that Captain Ahab one might be my first issue. I’d really like to explore the idea of A-symmetrical happiness activities.)

I’ll cover topics from philosophy, psychology, futurism, tech, finance and more.

Anything I would like to get some “minor insight” into.

If you like the sound of that, you can subscribe for free here.

I hope you come along for the ride because I think it’s going to be a lot of fun.

But I also know many (most… all? … I guess we’ll see) of you just subscribe to coin confidential to learn more about crypto.

With that in mind…

Where do I recommend you now go for your crypto news and insight?

(All of the following are free and I have no affiliation to any of them.)

For news, it’s hard to beat Axios crypto.

Subscribe to Axios crypto here.

They have a daily crypto newsletter, and are often first to get the most important stories.

Also, unlike most crypto news, Axios is a very reputable financial publisher that has well-regarded newsletters on various topics.

So when they publish something, you can be reasonably confident it’s actually true – and unbiased… which is extremely rare when it comes to crypto.

And in terms of a more personal newsletter, recently I’ve been enjoying The Pomp Letter, by Anthony Pompliano.

Subscribe to the Pomp Letter here.

Pomp is a long-time Bitcoin bull. And until recently he was mostly a Bitcoin maximalist. But lately he’s come around to Ethereum as well.

The good thing about Pomp is that he has a ton of connections in crypto, in finance, in tech… and he has a lot of insight into financial markets as well.

His newsletter definitely has more of a personal touch than Axios.

And then there’s my all-time favorite, Matt Levine.

Subscribe to his Money Stuff newsletter here.

Matt Levine writes about quirky financial news and ideas. Over the last few years he’s also covered pretty much all of the big things that are happening in crypto, too.

And he has a great writing style. Even if you’re not super interested in the esoteric financial ideas he writes about, I’m sure you’ll enjoy the way he writes about them.

Matt Levine is also probably THE most “legit” financial writer in the world. See: A Columnist Makes Sense of Wall Street Like None Other for more on that.

Okay, with all of that out of the way, let’s get on with this final issue.

We’re going to take a look at where crypto is at, and where it may be going…

Where we’re at with crypto right now

The year is 2024.

The US presidential election is four months away, and both candidates are chasing the “crypto vote.”

Donald Trump – who, in his previous presidential reign said this about Bitcoin:

Is now saying this:

And Joe Biden, who appointed Gary Gensler as head of the SEC (we all know how Gary feels about crypto and his extreme efforts to wipe it from the face of the earth) has even started courting the crypto vote.

As The Hill reported earlier this month:

The Biden administration opened a line with the cryptocurrency industry Wednesday, as the White House and Democrats find themselves increasingly at odds with powerful players in the digital assets space.

Anita Dunn, a senior adviser to President Biden, met with dozens of crypto leaders in her personal capacity Wednesday at a roundtable organized by crypto-friendly Democratic Rep. Ro Khanna.

Even JPMorgan’s CEO, Jamie Dimon – who previously said he’d fire any employee that traded Bitcoin and called crypto a “fraud” that “won’t end well”, and more recently said if he was in government he’d shut Bitcoin down – has reportedly come around.

Meanwhile BlackRock – the biggest asset manager in the world with $10 trillion assets under management – has not only launched a Bitcoin ETF, but it’s even started tokenising some of its funds on Ethereum.

And Goldman Sachs – the great vampire squid itself – is launching three new tokenisation products this year.

What I’m saying is, since I started writing this newsletter, crypto has put itself on the map.

In terms of the general population, it’s gone from a fringe idea to one of the key topics of the 2024 US election.

In terms of finance, it’s gone from something the big banks wanted to stamp out – to something they are all now embracing.

And in terms of the crypto community itself… hmm.

Well, it’s gone from a fun counterculture to, well… with the popularity of memecoins right now I guess it is still mostly just a fun counterculture in one sense.

But what’s really happened is it’s gotten so big that it now has many, many different pockets within it, all pursuing different things.

We have memecoins and fun – whose massive popularity I saw Matt Levine saying could be a result of Gary Gensler’s crypto crackdown:

The SEC’s view is essentially that it is illegal to publicly offer a cryptocurrency that represents an investment of money in a common enterprise with profits to come solely from the efforts of others. But an investment of money in nothing, with profits to come solely from memes, is fine. So you get the crypto projects that regulation allows. The SEC encourages crypto to be dumb, and crypto obliges.

We have degens and defi – which I’ve written about a lot.

We have serious DeFi – which I’ve also written about a lot. See: In defence of DeFi and Vitalik, vampires and the birth of Decentralised Finance.

We have the Bitcoin maxis – people who think all crypto other than Bitcoin is trash and shouldn’t exist.

We have the Ethereum maxis – who are like Bitcoin maxis but for Ethereum.

And we have the alt-coin upstarts – people always looking for the next “world changing” alt-coin.

There is a ton going on. And all of the crypto subcultures have grown over the years and spawned their own subcultures.

I mean, look at Shiba Inu – a meme of a meme, which is now the 14th largest crypto by market cap.

Meanwhile, many promising altcoins that were aiming to topple Ethereum from its perch – or at least exist alongside it – have fallen into the dark forest of abyss.

The only one to truly break through has been Solana.

I guess the most interesting question now is – will any others break through, or has that horse bolted?

With that in mind…

Now let’s explore where crypto is heading

Not long after I first launched coin confidential, I wrote three articles on what I thought would be the biggest crypto trends for 2020.

They were:

Central Bank Digital Currencies (CBDCs). See: Everything you need to know about Central Bank Digital Currencies.

Security Token Offerings (STOs). See: How Security Token Offerings (STOs) will forever change global finance.

And Decentralised Finance (DeFi). See: What is DeFi and why is it such a big deal?

As I recall, not a whole lot happened with any of them in 2020.

But come 2021, they were all HUGE topics. And they’ve continued to gain traction ever since.

Here’s how the Total Value locked has looked in DeFi since 2020:

Looks like I was about 6-months early. But overall I was pretty bang-on.

Only, I wasn’t…

Because DeFi has yet to really break into the mainstream – which is probably why Bitcoin is the only real crypto project to gain any real traction.

But, with the way things are going in America, and in Europe (with the new Mica regulation) I could see DeFi really taking off over the next couple of years.

Especially if central banks start cutting interest rates.

This would have two big consequences for DeFi and DeFi projects.

1. Investors will go on a search for yield – which could push them towards DeFi.

2. Venture Capitalists and other “money men” will be able to borrow money at much more favourable rates and so will begin funding many new projects… with the hope of big returns.

Which brings me to STOs.

That hasn’t exactly played out the way I thought it would. Crypto faced much more red tape and much more hostile regulators – like good old Gary – that I anticipated.

However, tokenising securities has become big business.

So much so that six months ago, BlackRock’s CEO, Larry Fink, said:

We believe the next step going forward will be the tokenisation of financial assets. That means every stock, every bond will be on one general ledger.

We can customise strategies through tokenisation to fit every individual.

We would have instantaneous settlement, think about all the costs of settling bonds and stocks. If you added tokenisation everything would be immediate.

We believe this is a technological transformation for financial assets.

And remember BlackRock is the biggest asset manager in the world with $10 trillion under management, which is more than triple the entire GDP of the UK.

And its CEO is saying every stock and bond is going to be tokenised.

It’s absolutely incredible. And it’s something no one could imagine happening back when I started writing this in 2019.

Well… I guess I did imagine it. But I’m not sure that even I believed it would actually happen.

The interesting thing is going to be – which “ledger” will all these assets be tokenised on?

We’re going to look into that next.

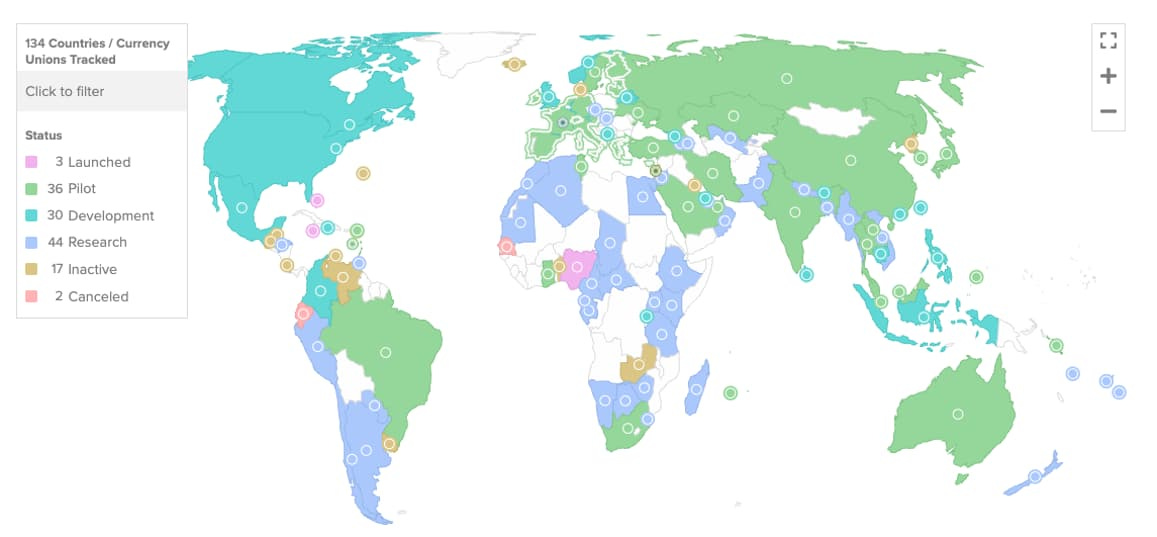

But first, let’s see how that third topic is doing since I first forecast it in 2020: CBDCs.

Well, basically the whole world is now either developing a CBDC or is already piloting one.

Take a look:

In fact, the Atlantic Council states that 134 countries, representing 98% of global GDP are exploring a CBDC.

And 19 of the G20 are in the advanced stages of CBDC development.

So, CBDCs are not something that’s going away anytime soon. In fact, it looks like they may be an inescapable aspect of our futures.

That’s certainly a lot less fun than the advancements in DeFi and the tokenisation of securities.

But, as the popular saying goes… it is what it is.

And to finish, let’s take a look at crypto projects themselves

Okay, I’ve set up two “open loops” which I plan to close in this section.

Open loop one: will any other altcoins break through?

Open loop two: which ledger will all the world’s securities be tokenised on?

And the answer is – I don’t know.

But let’s explore some possibilities anyway…

I think these questions are very related – if lots of securities and serious real-world assets start getting tokenised on an altcoin’s network, it will break through.

In the meantime, it looks like nearly everyone is tokenising on Ethereum. And it will probably stay that way until one of two things happens.

Either Ethereum will prove too slow to handle all this traffic.

Or Ethereum will evolve enough to handle all this traffic.

Right now, there isn’t much incentive for people like BlackRock to tokenise on any crypto platform other than Ethereum.

Institutions like BlackRock tend to use Ethereum or make up their own centralised ledger instead – a la JPMorgan.

But as Solana gets bigger – and gets its own ETFs – I could see institutions starting to use it alongside Ethereum. And maybe eventually instead of Ethereum.

Right now, in the wake of the FTX saga, and the continued crackdown from the Securities and Exchange Commission, it’s hard to see any other altcoins breaking through.

But as the US begins to truly embrace crypto, it will open the door for much smaller projects to flourish – without fear of being sued out of existence.

Which I believe could lead to a whole new DeFi revolution, much bigger than the one we saw in 2022.

And that would lead to massive financial innovations, which would eventually be adopted by traditional finance.

Chances are, at least some of those DeFi innovations will come from entirely new projects. Or at least projects that have yet to see the limelight.

Of course, Bitcoin and Ethereum are likely to stay at the top of the pile. But there is plenty of room at the top.

And if a smaller project comes up with something truly useful and groundbreaking it will rapidly rise through the ranks.

We’ve seen it happen time and time again in crypto. And I don’t think we’ve seen the end of altcoins yet.

Far from it.

But I guess we’ll have to wait and see.

And on that note, I’m going to leave you.

As always, thank you for reading.

And remember, if you’d like to keep on reading my writing – subscribe to Minor Insight here.

Okay that’s all for… ever?

Let’s just go with that’s all for today. It’s less depressing.

Now, in the immortal words of Bilbo Baggins:

“I need a holiday. A very long holiday. And I don't expect I shall return. In fact I mean not to.”

Thanks for reading.

Harry